One of the many things we learned from IMG was how to build your wealth the right way.

Before, I knew that investing in stock market can bring you a lot of money, though I also knew the huge risk behind it, I believed it was only for rich people who have extra money they can gamble with. I have a lot of friends getting into it, it even came to a point that they look crazy coz all they do at work was look at the trend and time when to get their money. Some get lucky and triple their money but most of the time they lose money. Why? Probably because taking into your hands this role requires a lot of study and experience.

I also see other investments like insurances, health care, education plans are just extra costs in my life. I will just save my money in the bank for those responsibilities. Or save money to invest in my own business as source of income.

Things changed after I joined IMG. After seeing the X curve concept and the Power of 72 I realized that I was wrong. Like building your house, it needs a solid foundation otherwise it will collapse and could not withstand time.

As a member of IMG I learned that this is how we should build our wealth:

Wealthy people follow a financial plan more or less similar to what is mentioned in this post. It’s time for us future wealthy people to apply one too.

We must build our financial plan in this order:

1. HEALTHCARE

this will cover our medical expenses when we get sick during our working age and when we eventually retire

short-term healthcare – provided by our employers while we are employed but stops when we resign, terminated or retire

long-term healthcare – medical expenses coverage during our retirement age

2. PROTECTION

in case something happens to us (death or disability), our families would receive a certain amount of funds to cover our inability to earn income

this is addressed by getting a life, disability or income protection insurance

3. ELIMINATE DEBT

We can’t afford to invest if we are burdened with debt. We must settle and eliminate our debt first.

If our debts are interest-bearing, the interest will just eat up both our funds and the potential gains from our investments

It is not advisable to borrow money for investment.

4. EMERGENCY FUND

reserved funds to cover our unexpected expenses during emergencies like disasters and job loss

must be at least 3 to 6 months of our income, if we are earning P10,000 per month then we need to have at least P30,000 to P60,000 set aside as our emergency fund

must be kept in a readily accessible bank account

5. INVESTMENTS

The first 4 steps should be addressed first before investing.

You can invest in mutual funds, stocks or real estate

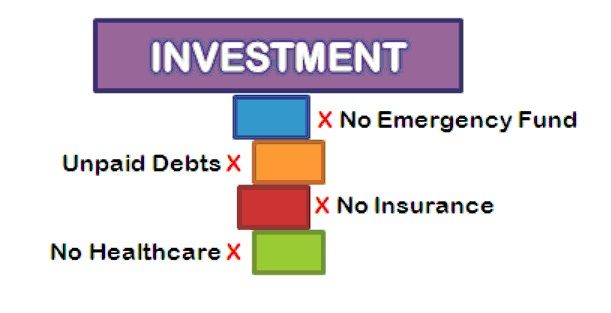

Most of us, new investors, would go straight to investments. We get blindsided by the high rate of return of investing in stocks or the opportunity to own real estate. We don’t bother to go through the lower levels.

Highly likely most new investors have most of their saved money in stocks, mutual funds or real estate investments. Their financial picture look like this:

Going directly to investments means a financial disaster waiting to happen.

If you get sick and hospitalized, you just can’t show your stock certificate, mutual fund statement or contract to sell to the hospital.

The most likely thing you’ll do is to withdraw or sell your investments to pay off your medical expenses.

What if the stock market is down or you haven’t fully paid your real estate investment?

It’s either you give up your investment at a loss or you borrow money just to cover your hospital bills.

This is when you appreciate the importance of having a health insurance. Instantly, you’ll have funds to cover your medical expenses without giving up your investment.

The same scenario happens if an emergency arise or something bad happens to you. Putting most or all of our money in investments is definitely not a good move.

I did not know about building a solid financial foundation. What I only cared about is how to make my money grow quickly at the highest rate of return possible.

When I joined the International Marketing Group (IMG), I learned that achieving financial freedom takes time and there are no short cuts. We all must go through a process.

At the moment, I am slowly correcting and building the base of my financial foundation.

I am setting aside some money each pay day to the bank to serve as my emergency fund, target is to have at least 3-6 months equivalent of my income

Regarding debts, like my mentor usually say, it sounds like death, so don't get buried with it. There are good debts and bad debts. Good one are those used to earn money lets say for example you took a loan to setup your own business for additional income, bad wants are simply those what we want and not need as cause of our lifestyle. So I started eliminating the bad ones, always pay loans and credit cards more than the minimum amount to pay them as early as possible saving you lots of money. It a matter of priority and discipline.

We also have our Ultimate Kaiser Health Builder for our long term Health Care, though we have the short term ones provided by the company we work with. You may see it redundant but ask yourself this? What if I lose my Job? what if I am over 60? Besides what's great about this product is that your money grows overtime. Kaiser also serves as my life and disability insurance if something happens to me. Definitely a 3-in-1 investment. I will discuss the Ultimate Kaiser Health Builder in a separate post.

Now with your extra money, you can safely place them in other investments like Mutual Funds and Stock Market which I will also discuss separately in this blog. That will depend on your need and preferred risk of course.

You may be thinking "gee Mac you probably have a lot of money for those???" Haha that I wish!!!

Like famous Robert Kiyosaki said " being wealthy is not about what you make but about what you keep"

It is not how big you earn but what counts is how big you can save for the future.

This is not a quick rich scheme. This requires priority and a lot of discipline.

Most of us have the following formula:

MONEY - EXPENSES = SAVINGS

Why not change the formula?

MONEY - SAVINGS = EXPENSES

By doing this you surely can achieve your goal. Remember focus on your assets and not your liabilities.

START MAKING YOUR FINANCIAL PLAN NOW

NEVER PROCRASTINATE

“The sooner I fall behind, the more time I have to catch up.”

No comments:

Post a Comment